It’s a simple fact. Pipes can’t fix themselves. When you have a problem with them, someone needs to take care of it. For a leak here or there, your maintenance staff or a local service technician may do.

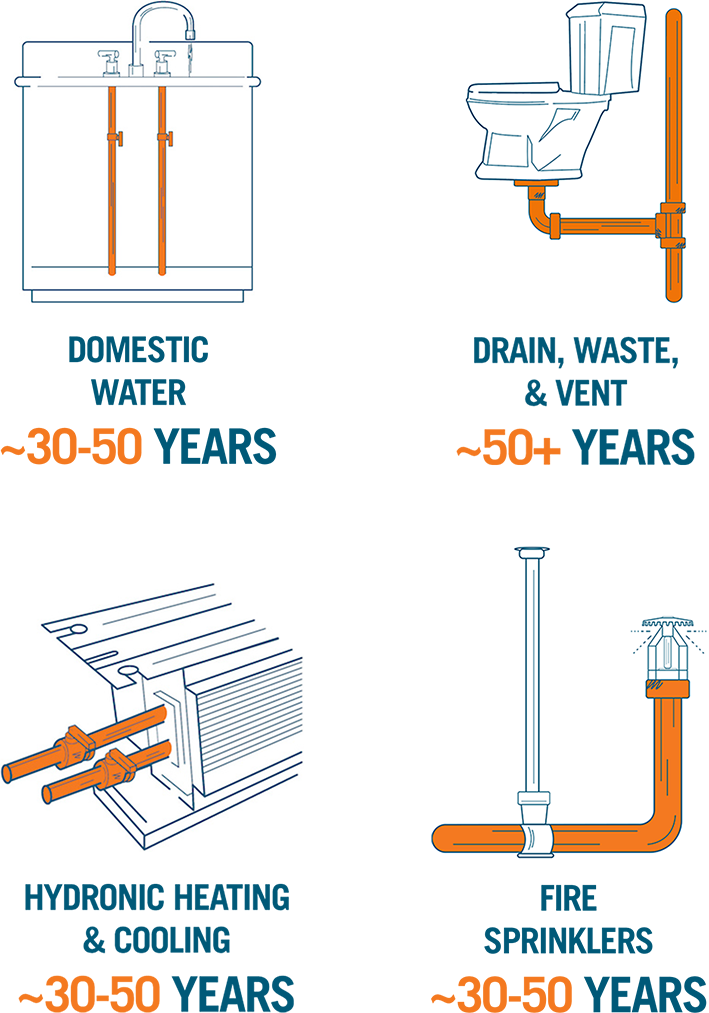

When you’re replacing lots of pipes because a plumbing, mechanical, or fire sprinkler system is failing, “maintenance” is like plugging a dam with your finger. For the good of your building and residents, you’ll need a contractor that has expertise in renovating these systems.

While the industry has evolved to easily address system-wide pipe replacements, it’s still an expensive proposition. Being prepared financially is often the most challenging part for both apartment and condominium owners and operators. It’s imperative that you plan ahead, well before the repipe project is necessary.

So, what can you do to ease the financial pain of repiping your community? Read on for the top three tips.

1. Timing Matters. Look Ahead.

Multifamily apartment owners and operators who are acquiring an asset can turn a sharp eye during due diligence to assessing the state of critical piping infrastructures. If a system will reach the end of its useful life during your hold period or the maintenance cost is already eroding NOI, include replacing the system in your budget. Even if you’ll wait a few years before starting the project, include the cost in your capital planning so you don’t exceed annual operating budgets.

Of course, multifamily owners with a long-term hold strategy can set aside funds over an extended time in your capital reserves to help maintain profitability when it comes time to repipe a critical system.

Condo communities can start reserving early. You’ll mitigate insurance policy risks and the need for high special assessments and hikes in monthly fees. We suggest you start to earmark reserves for piping infrastructure replacements as soon as your bylaws permit and at least 20 years ahead of when research indicates that a system will reach the end of its useful life. Acting early can mean smaller assessments and a smaller loan if you need additional funding.

2. Understand the Cost

You can’t plan to pay for a pipe replacement project unless you have an idea of what it’s going to cost, so get an estimate.

It’s probably written into your ROI playbook, but we’ll say it anyway. For apartment community owners that operate with 5 -10-year capital budgets, use your acquisition due diligence to determine if a plumbing or mechanical system is having troubles. If it is, get an estimate to rehabilitate it and put it in your budget. A leaky community can literally bleed you dry with damages, repair and insurance costs, vacancies, and poor reputation. Don’t get caught plugging leaks every day because you didn’t plan for the larger project.

For condo boards, having a detailed cost budget can help you decide if you’ll fund the project with reserves, a special assessment, a loan, or a mix of these approaches. Getting an estimate is free, so why wait? Once you know what you’re in for, it becomes easier to decide how you’re going to pay for it.

Is your community already experiencing signs of an aged or defective system, but you’re unsure whether you need to repipe now? Get a low-cost forensic analysis like the SageWater Pipe TEST (a Technical Evaluation of System Threats) to help inform the timing and scope requirements. A comprehensive report like the Pipe TEST will include a project estimate if the analysis indicates that you need to repipe.

3. Bank on It

One thing is for sure: your pipes aren’t getting any younger. We can guarantee that at some point, you’ll need to address your aging plumbing and mechanical infrastructures with a renovation project. And even when you’ve been preparing financially for it, it can be challenging to fund the project.

Fortunately, as the industry has evolved, banks are ready to help you with financing. It has become easier as they’ve become familiar with the “occupied” repipe process—or the process of replacing a community’s piping infrastructure while residents remain in their homes.

Whether you’re an owner acquiring a new property and need extra cash in your loan for a repipe, or a condo community looking to borrow for the project (or the repipe project in combination with other capital improvements), your bank wants to help. After all, loaning you money is how they make a living, and many have created teams who specialize in lending to you.

Of course, banks will require records of your financial state so be prepared to share income, expense, and insurance histories. And shop around to explore your options. If you need banking referrals, let us know. We’re happy to help.

In the end, there’s nothing worse than having a systemic piping problem and no funds to fix it. It creates strain on your staff and your residents. Fixing your pipes, one leak at a time, is simply a losing battle—and it costs much more while also disrupting the quality of life for everyone in the community. Don’t wait for signs of an aging or troubled piping system to show up. And if those signs have started, act fast. Plan ahead as early as possible, and don’t get stuck with your finger in the dam trying to stop your next leak!